February 22, 2026 | 03:55 pm

TEMPO.CO, Jakarta – Bank Indonesia said it will consistently steer its 2026 monetary policy to keep inflation within the 2.5±1 percent target range and safeguard rupiah stability, as part of efforts to support sustainable economic growth.

Ramdan Denny Prakoso, Executive Director of BI’s Communication Department, said the central bank would pursue a pro-market monetary operations strategy throughout the year.

“Bank Indonesia consistently directs its monetary policy for 2026,” Denny said in a written statement on Sunday, February 22, 2026.

He explained that the strategy aims to ensure adequate liquidity in the money and banking markets. Measures include managing the structure of interest rates and the volume of monetary instruments, as well as conducting purchases and sales of government bonds, known locally as Surat Berharga Negara (SBN), in the secondary market.

According to Denny, BI’s buying and selling of SBN in the secondary market will be carried out in a measured manner under its monetary control program. The approach, he said, adheres to prudent monetary principles and remains aligned with the inflation target while supporting stronger economic growth.

BI also reaffirmed close coordination with the Ministry of Finance of the Republic of Indonesia regarding the issuance and management of government bonds. Both institutions agreed that SBN issuance by the government and BI’s secondary-market purchases would be conducted in line with prudent fiscal and monetary policies, while upholding market discipline and integrity.

In practice, BI’s SBN purchases will be conducted through market participants and via a bilateral bond exchange mechanism with the government. The instruments involved are tradeable and priced according to prevailing market mechanisms.

For 2026, BI plans to carry out SBN debt switch transactions with the government in line with the value of bonds maturing that year, amounting to Rp173.4 trillion.

The transactions will be conducted gradually using SBN holdings already on BI’s balance sheet, with settlement completed before maturity in accordance with prevailing regulations.

The bilateral SBN exchange mechanism between the Finance Ministry and BI has been implemented in previous years, including 2021, 2022, and 2025.

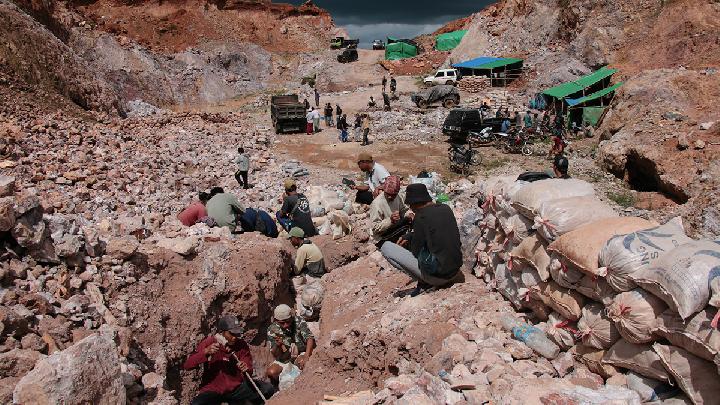

Read: US Demands Indonesia to Lift Critical Mineral Export Restrictions

Click here to get the latest news updates from Tempo on Google New

How Crisis-era Monetary Policy Reshaped the Limits of Central Banking

18 Desember 2025

Slowing growth, political shocks and high public debt have made central bank decisions more influential than ever.

Bank Indonesia Outlines Monetary Policy Direction for 2026

29 November 2025

This monetary policy direction is chosen amidst the ongoing global uncertainty.

Waiting for a Bubble to Burst: Decoding the Next American Financial Crisis

4 November 2025

A profound and counterintuitive anomaly in American markets, where both risk assets and safe havens are simultaneously hitting record highs.

Indonesia's Financial System Remains Stable in Q3 2025, Says Finance Minister

3 November 2025

Finance Minister Purbaya Yudhi Sadewa outlines Indonesia's financial system to remain stable in the third quarter of 2025. Here are the key points.

Bank Indonesia Buys Rp124.33 Trillion in Government Bonds

18 Juni 2025

Bank Indonesia purchases SBNs to strengthen liquidity expansion in monetary policy and reflect the synergy between monetary and fiscal policies.